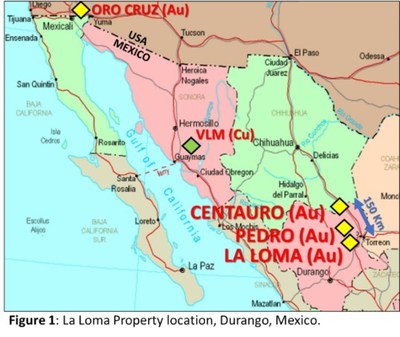

VANCOUVER, BC, Dec. 19, 2022 /CNW/ – Southern Empire Resources Corp. (Southern Empire) (TSXV: SMP) (Frankfurt: 5RE) (OTC: SMPEF) announces the acquisition of the 23,750 hectare («ha»; 58,687 acre) La Loma gold property by staking. La Loma is located in Durango State, México approximately 50 kilometres («km») southeast of Southern Empire’s Pedro Gold Project and 35 km west-southwest of the major city of Torreón (see Figure 1).

Southern Empire also announces the expansion of its recently optioned Centauro Gold («Au») Project (see Southern Empire news release dated December 12, 2022) located near Jiménez, Chihuahua from an original 600 ha to 4,432 ha (10,951 acres) with the staking of the Tauros and Centauro 2 claims.

«Southern Empire’s La Loma, Pedro and Centauro gold projects support our theory that a northwest trending metallogenic belt of «Carlin-style» and/or low sulphidation epithermal gold deposits extends through northern central México. Our projects all exhibit many of the geological and mineralogical features that define these important precious metal deposit types,» stated David Tupper, Southern Empire’s VP of Exploration.

La Loma Property

Southern Empire’s La Loma, Pedro, and Centauro Gold Projects occur within the north Mexican Oligocene Basin and Range physiographic province. These three project areas define a 150-kilometre trend of gold occurrences that are associated with arsenic-mercury-antimony mineralization, together with silica and clay alteration, all hosted in the same package of Cretaceous limestones and mudstones and Tertiary ignimbrite eruptive and polymictic conglomerate lithologies.

As part of the «Laramide» Lower Cretaceous to early Tertiary, Mexican Fold and Trust Belt, the stratigraphy of the area exhibits repeated, elongate north-south folds that are regularly interrupted by moderate- to high-angle thrusts and later extensional faulting (see Figure 2).

A significant portion of the La Loma property covers «Terrano Naccional» (federal land) and is therefore unencumbered by private or communal Ejido ownership (see Figure 2). Access is limited to several broad, ephemeral riverbeds (arroyos) extending from the south.

The La Loma property covers a large, unexplored area having Au, arsenic («As»), antimony («Sb»), mercury («Hg»), molybdenum («Mo»), and silver («Ag») stream sediment geochemical anomalies as reported by the Secretaria de Economia de México, («SGM») in 2006 (see Figure 3). This government stream sediment sampling survey was completed at a low, regional density. Additionally, much of the regional geological mapping was accomplished with the aid of stereoscopic interpretation.

Hyperspectral mapping (ASTER 2003/06; see Figure 2) shows that these geochemical anomalies are often coincident with zones of strong silica alteration.

The SGM regional geochemical sediment sample results also suggest significant potential for Carbonate Replacement Deposit («CRD») mineralization in the La Loma area, especially with the Ojuela and La Platosa CRD mines (both now closed) located only 50 km to the north. Significant anomalies supporting the prospectivity for CRD mineralization also occur to the southeast of the La Loma claim, however this is a protected area.

At La Loma, Southern Empire has planned exploration programs for spring 2023 that will include:

Higher density stream sediment sampling

Prospecting and preliminary geological mapping

Centauro Property Expanded by Staking

The Centauro property has been significantly expanded by staking two claims totalling 3,832 ha that surround the 600-ha claim block, which is held under option by Southern Empire. This staking extends the project area up to 7 kilometres to the west (see Figure 4).

The Tauros and Centauro 2 claims cover areas of silica and kaolinite alteration, and lesser alunite and buddingtonite alteration, as recently identified and mapped (by analysis of Worldview-3 hyperspectral data) along trend and to both the northwest and the northeast of the original Centauro claim block. These suites of probable alteration mineralization are often spatially associated with «Carlin-style» and/or low sulphidation epithermal gold mineralization observed at Centauro to date.

Southern Empire has initiated negotiations to secure surface access rights at the Centauro Gold Project with the local rancher owners who have worked with the claim owner for more than 30 years.

Qualified Person (QP)

The scientific and technical information contained in this news release has been prepared, reviewed and approved by David Tupper, P.Geo. (British Columbia), Southern Empire’s VP Exploration and a Qualified Person within the context of Canadian Securities Administrators’ National Instrument 43-101; Standards of Disclosure for Mineral Projects (NI 43-101). The historical analytical data contained in this news release was obtained from public disclosures and data of the Secretaria de Economia de Mexico, Silver Spruce Resources Inc. and Mundoro Capital Inc. and has not been verified by the Qualified Person.

About Southern Empire Resources Corp.

Southern Empire is focused on the acquisition, exploration and development of metals and minerals deposits in North America.

In northeastern Durango State, México, Southern Empire has an option to acquire a 100-per-cent beneficial interest in the 1,750-hectare Pedro Gold Project. At Pedro, in the spring of 2022, Southern Empire drilled gold mineralization approximately 800 metres from 2014 drilling by a subsidiary of Newmont Mining Corporation. Gold mineralization, associated with highly anomalous arsenic (orpiment and realgar common), antimony, mercury and thallium, has been identified hosted in permeable basal conglomerates deposited during Oligocene extensional deformation, the latter forming widespread Basin and Range physiography along the easter part of Sierra Madre Occidental. Gold is present in 12 of the 17 holes drilled at Pedro to date. Please see Southern Empire’s news releases posted on SEDAR for further details.

In the Cargo Muchacho mountains of Imperial County, California, Southern Empire owns 100 percent of the historical gold-producing American Girl mine property and holds options to acquire a 100 percent interest in the adjacent 2,160-hectare (5,338-acre) Oro Cruz Property located approximately 22.5 kilometres (14 miles) southeast of the operating Mesquite gold mine of Equinox Gold Corp.

At Oro Cruz, extensive historical drilling and large-scale open-pit and underground mining of the American Girl, Padre y Madre, Queen, and Cross oxide gold deposits by the American Girl Mining Joint Venture («AGMJV») occurred between 1987 and 1996. During that time, gold was recovered by either heap leaching of lower-grade, or milling of higher-grade ores until AGMJV operations ceased in late 1996 because of declining gold prices leaving the Oro Cruz Property with many gold exploration targets in addition to a historical inferred resource estimate, reported In 2011 by Lincoln Mining Corp., totaling 341,800 ounces gold based on 4,386,000 tonnes averaging 2.2 grams gold per tonne (g Au /t) at a cut-off grade of 0.68 g Au/t (4,835,000 tons at 0.07 ounce gold per ton; please refer to the Cautionary Notice Regarding the Oro Cruz Property Historical Resource Estimate below).

On behalf of the Board of Directors of Southern Empire Resources Corp.,

Dale Wallster, CEO and Director

Cautionary Notice on Forward-Looking Information

Information provided in this news release may contain forward-looking information or forward-looking statements that are based on assumptions as of the date of this news release. Such information or statements reflect management’s current estimates, beliefs, intentions, and expectations and are not guarantees of future performance. Southern Empire cautions that all forward-looking statements are inherently uncertain and that actual performance may be affected by many material factors, many of which are beyond its respective control. Such factors include, among other things: risks and uncertainties relating to Southern Empire’s limited operating history, the need to comply with environmental and governmental regulations, results of exploration programs on its projects, and those risks and uncertainties identified in its annual and interim financial statements and management discussion and analysis. Accordingly, actual and future events, conditions, and results may differ materially from the estimates, beliefs, intentions, and expectations expressed or implied in the forward-looking information. Except as required under applicable securities legislation, Southern Empire undertakes no obligation to publicly update or revise forward-looking information.

Cautionary Notice Regarding Historical Resource Estimate

The Oro Cruz Project historical resource estimate is disclosed in a technical report dated April 29, 2011, prepared for Lincoln Mining Corp. by Tetra Tech, Inc. and filed on Canadian Securities Administrators’ System for Electronic Document Analysis and Retrieval («SEDAR»). It is termed an inferred mineral resource, which is a category set out in NI 43-101. It was based on historical reverse circulation and core drill hole sample, underground channel sample, and blasthole sample assay results and calculated using ordinary kriging to estimate gold grades in 10-foot-by-10-foot-by-five-foot blocks. Accordingly, Southern Empire considers this historical estimate reliable as well as relevant as it represents key targets for future exploration work. However, a QP has not done sufficient work to verify or classify the historical estimate as a current mineral resource and Southern Empire is not treating this historical estimate as current mineral resources.

Cautionary Notice Regarding Exploration Work Programs

The timing and the ability to conduct Southern Empire’s exploration programs are, among other things, contingent on: governmental regulations allowing for the issuance of permits; affects of the COVID-19 pandemic; and the availability of property access, exploration personnel, drill contractors, equipment, lodging, etc. Southern Empire will adhere to COVID-19 directives regarding safe working practices putting worker and community health and safety first and will proceed with exploration and development work programs only if potential COVID-19 risks can be effectively managed.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the Exchange) accept responsibility for the adequacy or accuracy of this release.

SOURCE Southern Empire Resources Corp.

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/December2022/19/c1807.html

Related Quotes

These rock-solid income stocks, with inflation-fighting yields ranging from 4.6% to 8%, provide plenty of reward with minimal risk for investors.

(Bloomberg) — Elon Musk pushed back on criticism from one of Tesla Inc.’s most vocal supporters amid growing concern about the chief executive officer’s ability to manage Twitter Inc. and his other businesses.Most Read from BloombergMusk Is Looking for a New Twitter CEO After Losing PollAmazon Ring Cameras Used in Nationwide ‘Swatting’ Spree, US SaysMessi Evacuated by Helicopter After Crowds Swarm World Cup WinnersRussian Gas Flows to Europe Unaffected After Pipeline BlastMusk Lashes Out at Unh

QuantumScape announced today it has begun shipping prototypes of its solid-state battery cells to potential automotive customers. The company has spent the past two years proving its solid-state battery concept and working toward a commercially viable unit. QuantumScape called today's announcement an important part of the commercialization process and said it was its "key public milestone for the year."

Tesla (NASDAQ: TSLA) shares continued a slide today that has sent the stock price plunging by 55% since late September. Tesla shares had been overvalued for a long time based on the fundamentals. Shares began retreating this fall when demand questions surfaced in its important Chinese market.

Against a backdrop of soaring inflation, a slowing economy and persistent rate hikes, assessing the playbook for the coming year, CNBC’s Jim Cramer says it’s more important than ever to look at the past year and see what worked. Basically, which stocks have managed to overcome the bear conditions. Within the components of the S&P 500, energy and utilities have been segments that have beaten the broader market, and generally speaking, so have those of the healthcare sector. But healthcare stocks,

Many investors, subsequently, try to offset their losses by turning to high-yield dividend stocks. The mortgage real estate investment trust (mREIT) Annaly Capital Management (NYSE: NLY) is one of the highest-yielding stocks in the market today, paying a juicy 16% dividend yield. Annaly Capital Management invests in mortgages and mortgage-backed securities (MBS) in addition to servicing loans for other mortgage companies.

Intel (NASDAQ: INTC) is enduring a painful year. Because of worsening economic conditions, the semiconductor manufacturer's revenue tumbled 20% in the third quarter, while its earnings plummeted even further. This painful situation led Intel to seek outside-the-box ways to finance its growth to maintain its balance sheet strength and investor payout.

Yahoo Finance sports reporter Josh Schafer breaks down Nike's second-quarter earnings results.

Stocks moving in after hours: Nike, FedEx, Workday

Most everyone loves an early holiday present. And for some real estate investment trust (REIT) investors, that early gift came in the form of a dividend increase over the past two weeks. Of course, a dividend increase is great because it puts more income into the pockets of investors and increases the yield on their purchase price, but more importantly, a dividend increase also signals to the markets that the company expects to perform well, perhaps generating increases in revenue and funds from

Nio (NYSE: NIO) stock has been turbulent recently, and for good reason. After a big dip yesterday on mounting fears of how the spread of COVID-19 will hurt Chinese consumers and the economy, Nio staged a comeback Tuesday morning. After losing that early jump, Nio's American depositary shares were holding on to a gain of 0.7% as of 12:50 p.m. ET.

The big market headline this year – all year – has been the steady fall in stocks. The S&P 500 is down 20% for 2022, and the NASDAQ has fallen a disastrous 33%. And while recent data shows that there may be some hope on the inflation front, there may still be storm clouds massing for next year’s stock market. That’s the view of Mike Wilson, Morgan Stanley's chief equity strategist. He’s been a leading voice among the bears this year, and he’s not changing that tune as we head into the New Year.

Today we will run through one way of estimating the intrinsic value of Roku, Inc. ( NASDAQ:ROKU ) by taking the…

Famed value investor Benjamin Graham introduced Mr. Market in his 1949 book The Intelligent Investor. Mr. Market, an allegory used to describe the irrational, erratic, and emotional behavior that can drive stock prices up and down, is a good lens through which to view the pandemic-era ups and downs of certain stocks. Carvana (NYSE: CVNA) and Coinbase (NASDAQ: COIN) have never made much sense as businesses, at least to me.

Yahoo Finance Live looks at Tesla stock amid analyst downgrades tied to Elon Musk's new involvement in Twitter.

IceCure Medical, a little-known medical device company surged in after-hours trading Monday. IceCure's Prosense technology proved to be a safe and effective treatment for cancerous kidney tumors.

Since electric-vehicle giant Tesla reported third-quarter numbers in October, negative stock-price momentum has been building, helping to complete a troubling head-and-shoulders stock-chart pattern that began in early 2021.

Yahoo Finance Live anchor Dave Briggs looks to Carnival Cruise Line's stock ahead of its latest earnings report due out before tomorrow's closing bell.

A little bounce action arrived Tuesday morning, and here's how I'm handling the market move — and what I'll do if it keeps up.

In this article, we discuss 11 best aerospace stocks to buy. If you want to see more stocks in this selection, check out 5 Best Aerospace Stocks To Buy. Economic recovery for the aerospace and defense sector gained momentum in 2022 on the back of increasing demand for air travel. As per an outlook survey […]